Finding budget-friendly car insurance can seem like searching for a needle in a haystack. With countless options and diverse prices, it is straightforward to become overcome by the process. However, grasping what constitutes cheap car insurance and recognizing your individual needs can convert this daunting task into a workable one.

Cheap auto insurance does not only mean selecting the least expensive price on the market. It requires finding a policy that balances good coverage with an affordable premium. By examining different approaches and taking into account various factors that affect car insurance rates, you can access the door to considerable savings while guaranteeing that you and your vehicle are properly protected.

Understanding Affordable Car Insurance

Cheap car insurance is an essential option for a lot of drivers looking to reduce their expenses while making sure they remain protected on the road. This type of insurance typically offers coverage at discounted premiums, making it an tempting choice for budget-conscious individuals and families. By understanding the various aspects of inexpensive auto insurance, you can make informed decisions and find the right plan that fulfills your needs without breaking the bank.

One key factor contributing to the affordability of inexpensive car insurance is the array of coverage options available. Usually, these policies may be devoid of certain features or have increased deductibles compared to more comprehensive plans. Still, they can yet provide crucial protection against liability, accidents, and other risks that drivers face daily. Examining your unique driving habits, vehicle type, and financial situation can help you achieve the best balance between cost and coverage.

Another important aspect of inexpensive car insurance is the different discounts that insurers may provide. These can include good driver discounts, multi-policy discounts for bundling car insurance with home or renters insurance, and discounts for infrequent drivers. By actively seeking out and asking for these discounts, you can more reduce your premiums and obtain a more cost-effective insurance solution customized to your circumstances.

Elements Determining Insurance Premiums

Coverage costs for affordable auto insurance can differ greatly based on various key elements. One of the primary aspects is the motorist's years and driving background. Younger drivers typically face increased costs due to their novice status on the road, making them statistically more likely to be involved in collisions. On the contrary, experienced drivers with a clean background of safe driving are often given with lower rates.

A further significant factor impacting vehicle insurance costs is the kind of vehicle being covered. High-performance cars or expensive vehicles generally come with elevated costs because they can be pricier to repair or substitute. Additionally, the car's safety ratings and theft rates can also impact the cost of protection. Vehicles equipped with advanced safety technology may be considered for savings, making cheap car coverage more available for such drivers.

In conclusion, the area where the car is primarily driven plays a crucial role in influencing premiums. Urban locales with increased traffic congestion and theft statistics typically see elevated premiums compared to rural regions. Insurers often assess the risk of incidents and loss in specific areas, which can create substantial differences in rates. Comprehending these factors can help drivers make informed decisions when seeking inexpensive insured solutions.

Methods to Reduce Costs on Car Insurance

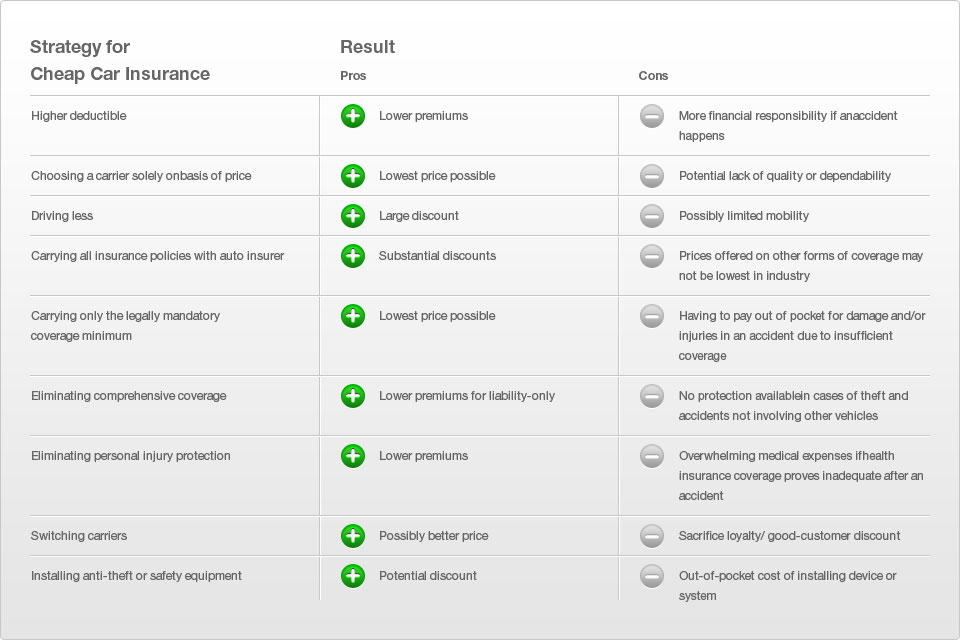

One effective way to get savings on affordable car insurance is by comparing quotes from different providers. Each insurer has its own criteria for setting rates, so obtaining quotes from different companies can reveal options for significant discounts. Utilize online comparison tools to streamline this process, allowing you to evaluate coverage types and pricing efficiently. By exploring multiple policies, you may find a plan that offers better coverage at a reduced cost.

Another method for minimizing your premiums is to leverage discounts offered by insurance companies. Many insurers provide savings for conditions such as having a good driving record, bundling policies, or completing a defensive driving course. Additionally, students with strong grades and affiliates of certain occupational organizations might also be eligible for unique discounts. Always ask your provider about accessible discounts, as they can greatly reduce your overall outlay.

Finally, consider modifying your coverage parameters to align with your current needs. If your vehicle is older or has a decreased market value, it may not be essential to carry all-inclusive or collision coverage. By switching to minimum coverage, you could reduce significantly on your payments. Just ensure that you evaluate your monetary situation and safety needs before executing any changes, as finding the right equilibrium between inexpensive coverage and appropriate protection is important.

Types of Cheap Auto Insurance

When searching for cheap auto insurance, it's important to know the various types of coverage available. The primary form is liability insurance, which is obligatory in most states. This type of coverage protects you in the event that you cause an accident and are held responsible for damages or injuries to another party. Though it provides important financial protection, it may not cover your vehicle in case of damage or theft, which makes it a cost-effective option for budget-conscious drivers.

A different common type of cheap car insurance is collision coverage. very cheap car insurance no deposit texas pays for damages to your vehicle resulting from a collision with another vehicle or object, regardless of fault. Although collision coverage can increase your premiums, opting for a higher deductible can help lower costs. For those who drive older cars, this may be a good option, as the risk of high repair costs is more manageable.

Another key type of insurance is also a key player in the world of cheap auto insurance. This coverage protects against non-collision-related incidents, such as theft, vandalism, or weather-related damages. Although comprehensive coverage usually comes with an additional cost, it can be a wise investment for drivers who want peace of mind. Evaluating your vehicle's value against the cost of comprehensive insurance will help determine if it is a worthwhile option for you.

Evaluating Insurance Companies

While hunting for affordable cheap automobile coverage, you should to evaluate multiple insurance providers to discover the most suitable option suitable for your requirements. Many companies offer diverse prices, coverage options, and promotions. Take the time to gather estimates across multiple insurers, because this helps you to comprehend the price range of the protection you need. Some might provide cheaper prices because of unique pricing models, so exploring various choices can reveal significant savings.

In addition to assessing prices, it is crucial to evaluate the insurance providers' standing and customer service. Search for providers that have robust financial strength and strong satisfaction scores. Reading online reviews and checking ratings from organizations such as J.D. Power and A.M. Best offers insights into how the companies treats customers and handles claims. A low premium is of little value if you face challenges when you need to use your insurance.

In conclusion, be on the lookout for discounts that may be available that are not always apparent. Various companies provide discounts due to safe driving records, combining policies, and for belonging to particular associations. Recognizing all the available discounts can decrease your overall cost. Through thorough comparison of providers, you may discover reasonable insurance and obtain the cheap vehicle insurance that satisfies your requirements.

Discovering Savings and Promotions

While on the hunt for affordable car insurance, it is essential to look into various discounts and offers. Many insurance companies present lowered rates for specific groups or situations. For example's sake, young drivers may gain positive student discounts if they maintain a good GPA, while seniors can get exclusive rates designed to their needs. Additionally, combining multiple policies, such as home and auto insurance, often results in substantial savings.

Another way to obtain cost-effective coverage is by taking advantage of safe driving discounts. Insurers frequently compensate policyholders who maintain a spotless driving record without accidents or traffic violations. Furthermore, enrolling in defensive driving courses can also lead to decreased premiums. Regularly consulting with your provider for current discounts and adjusting your policy can help ensure that you are securing the best deal.

Lastly, think about inquiring about loyalty discounts if you have been with your insurance provider for several years. Many companies appreciate long-term customers by giving reduced rates as a reward for their commitment. It is also advisable to compare and compare rates from various insurers to identify any promotional deals they may currently have. Being aggressive about looking for discounts can bring about substantial savings on inexpensive auto insurance.

Typical Myths Concerning Inexpensive Insurance

One shared belief about budget car insurance is that it always means poorer quality protection. A lot of people think that if they spend less, they receive less protection. In truth, there are numerous affordable choices on the market that still offer substantial protection. Numerous coverage companies may offer competitive premiums due to competitive strategies, proficient loss management, or by customizing coverage to suit specific driver requirements without compromising on protection.

Another fallacy is that budget auto coverage is only appropriate for unsafe drivers. While it is correct that people with a background of incidents or violations may be seeking for more budget-friendly policies, many safe drivers can also discover cheap options that suit their budget. Insurance providers often reward safe driving behaviors and good credit scores, enabling even careful individuals to benefit from cheaper premiums without sacrificing their protection.

Lastly, a lot of believe that reducing coverage limits or choosing higher deductibles is the only way to obtain budget auto insurance. While these strategies can lower costs, they may also increase monetary risk in the event of an collision. It's essential to determine an ideal compromise between cost costs and protection levels, ensuring that drivers maintain adequate protection on the road while still enjoying affordable insurance premiums.

Final Tips for Inexpensive Coverage

While searching for cheap auto insurance, don’t overlook the value of comparison shopping. Multiple insurers frequently provide vastly different quotes for the same coverage. Invest the energy to gather multiple quotes from multiple providers, and use online price comparison tools to accelerate the process. This will help you determine which companies offer the most competitive rates for your specific requirements.

Moreover, consider adjusting your coverage choices. While it might be tempting to go for the lowest possible price, ensure you are not compromising essential coverage. Examine your deductibles and limits, and explore options like higher your deductible for reduced premiums. However, be cautious—higher deductibles mean greater out-of-pocket costs in the event of a claim.

In conclusion, take benefit of discounts. Many insurance companies offer discounts for different reasons, such as safe driving records, combining policies, or even being a part of certain groups. Make sure to check about all potential discounts that may apply to you. Maximizing these opportunities can significantly cut your overall costs and make cheap car insurance even more cost-effective.