In terms of auto insurance, many drivers can become inundated with details, myths, and misunderstandings that can result in misjudgments and poor decision-making. Maneuvering through the landscape of car insurance can appear intimidating initially, particularly with countless opinions floating around about which policy you really need and how it functions. Understanding the truth behind these usual myths is crucial for every driver to ensure they are properly covered on the road.

In this piece, we will debunk some of the most frequently heard myths surrounding auto insurance and illuminate the realities that every driver should be aware of. Whether you’re a beginning driver searching for your first policy or a seasoned motorist revisiting your policy, knowing the facts can help you save money and enable you to make wise decisions regarding your car insurance. Let's set the record straight and help you drive confidently.

Comprehending Auto Insurance Basics

Auto insurance is a policy between the policyholder and the insurer that offers monetary coverage against claims and liabilities resulting from car accidents. The main purpose of auto insurance is to cover the costs associated with accidents, theft, or harm to your vehicle. Multiple types of coverage are available, including third-party coverage, collision coverage, and full coverage, permitting drivers to adapt their coverage to their own preferences.

Liability insurance is usually obligatory by law and assists pay for the costs of losses and wounds that you may create to others in an accident. Collision coverage, on the other hand, insures costs to your individual car resulting from a crash, irrespective of who is at responsibility. Full coverage safeguards against non-accident issues, such as robbery, property damage, or environmental catastrophes. Understanding these basic types of coverage is key for every driver when choosing a plan.

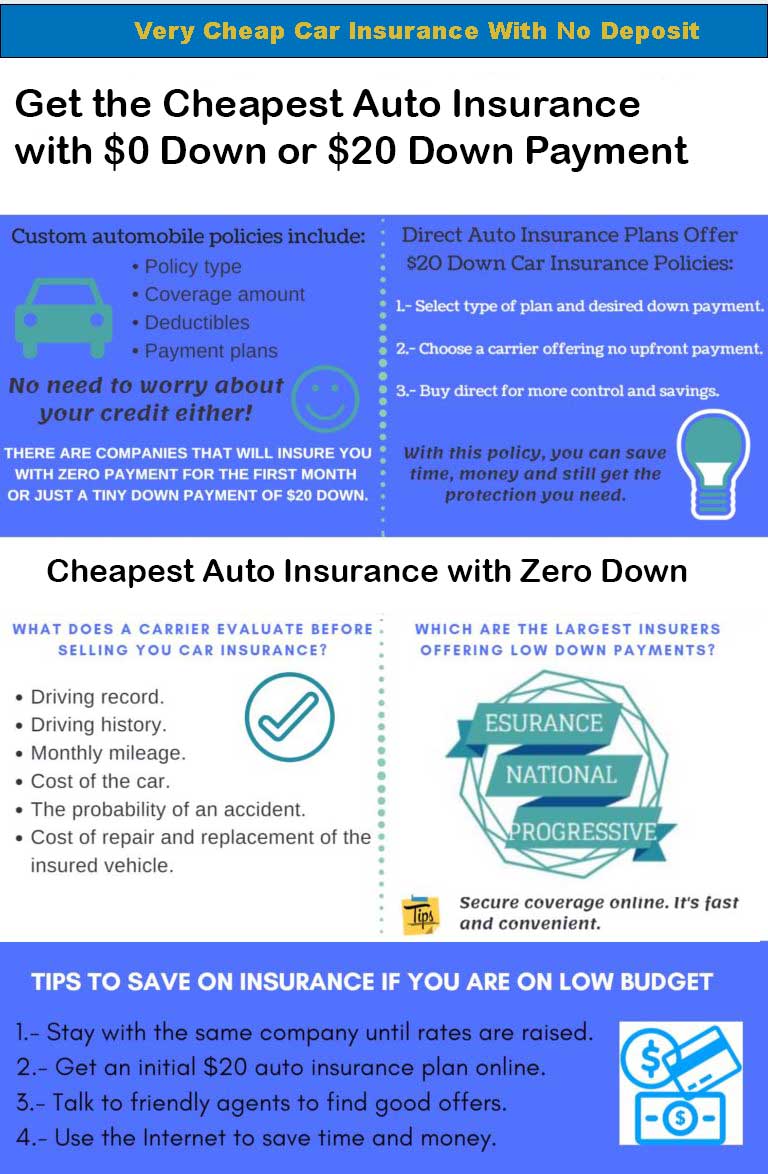

When obtaining auto insurance, aspects such as record of driving, the make and model of the vehicle, and personal credit background can impact policy prices. It is vital to compare and evaluate prices from various insurers to make certain that you get the best coverage for your requirements at a fair price. Being informed about the nuances of vehicle insurance can help drivers make informed decisions and prevent typical fallacies about vehicle insurance.

Frequent Misconceptions About Car Insurance

A lot of drivers think that their credit score does not affect their car insurance rates. Nonetheless, insurers frequently use credit data to help set premiums. A higher credit score can translate to lower rates, while a bad score may cause elevated costs. This approach is based on numerical correlations among credit scores and the likelihood of filing claims. Grasping this link can help drivers take steps to improve their credit and potentially save on insurance.

Another common notion is that red cars cost extra to insure. The shade of your vehicle does not influence insurance premiums. Insurers assess risk based on multiple factors such as the make of the car, safety ratings, and claims history rather than, its color. As a result, drivers ought not to be concerned about the hue of their vehicle affecting their insurance costs.

Lastly, many people think that they are fully covered just because they have auto insurance. Nonetheless, coverage can vary significantly depending on the policy. Some drivers may be underinsured or may not have comprehensive coverage, which could render them financially vulnerable in the event of an accident or theft. It's essential for drivers to understand their individual policies and confirm they have adequate coverage for their requirements.

Elements Which Influence Your Premium

When it comes to calculating the auto insurance premium, multiple important factors play a significant role. A critical element is your driving history. Insurers typically view an unblemished driving record positively, as it indicates you are lesser risk. Conversely, incidents, traffic violations, or claims can boost your premium considerably. Therefore, maintaining a safe driving record is vital for getting the rates.

Another important factor is the type of vehicle owned. Texas cheap car insurance analyze the safety ratings, theft rates, and repair costs related to different car models. For example, high-performance cars or luxury vehicles usually come with steeper premiums due to their repair costs and increased chance of being targeted for theft. Choosing a vehicle known for safety and reliability can help lower your insurance costs.

Lastly, demographic details such as your age, gender, and location can greatly influence the auto insurance premium. Young drivers often face higher rates due to their lack of experience on the road, while certain locations may have higher accident rates or theft, causing increased premiums. Understanding how these factors correlate can help you take knowledgeable decisions about the insurance coverage and potentially save money.

The Significance of Types of Coverage

Grasping the various types of insurance coverage available in automobile car insurance is crucial for all driver. Every type of coverage serves a specific purpose and can protect you in multiple situations. For instance, civil liability insurance is mandatory in many states and covers losses you may cause to others in an incident. Full and collision coverage safeguard your personal vehicle from loss, whether from accidents or additional events like robbery or environmental disasters. Knowing these differences helps you choose the most suitable insurance policies for your needs.

Another key aspect of coverage types is how they can influence your monetary security. In the case of an accident or damages, having the appropriate type of coverage can avoid significant out-of-pocket expenses. For example, if you were to create an incident without adequate liability coverage, you could be held accountable for expensive healthcare costs or property damage, putting your financial situation at risk. Therefore, comprehending and investing in the appropriate coverage guarantees that you are safeguarded against unexpected events.

Finally, it is crucial to assess your coverage types regularly. Your insurance needs may evolve over time due to factors such as the purchase of a new car, changes in your driving behavior, or even changes in your personal life. Regularly assessing your auto insurance coverage allows you to adjust to these shifts and ensure that you have adequate protection tailored to your current situation. Being aware about insurance options can result in better choices and calmness while behind the wheel.

How to Save on Auto Insurance

Saving on auto insurance is more achievable than most think. One successful strategy is to compare rates and check quotes from several insurance companies. Every provider has its distinct pricing structure, and even slight differences can lead to considerable savings. Websites that collect quotes can make this process easier, allowing drivers to quickly see various options that suit their needs. It is also important to review coverage options because some motorists may be paying for unnecessary add-ons that do not deliver adequate value.

Another way to reduce car insurance costs is through savings opportunities. Many insurers offer a range of discounts based on criteria such as clean driving records, bundling multiple policies, being a participant of particular organizations, or adding safety features in your vehicle. Taking the time to check on available discounts can reveal opportunities for lowering premiums. Additionally, maintaining a good credit score can help in achieving lower rates, as insurers often consider credit history when determining premiums.

Finally, consider adjusting your deductible. A higher deductible commonly yields lower monthly premiums, but it means higher out-of-pocket costs in the event of an insurance claim. Review your financial situation and determine what you can reasonably manage in terms of repair costs. By finding the right equilibrium between deductibles and monthly payments, drivers can find a cost-saving approach that suits their financial plan while still providing adequate coverage.

When to Review Your Policy

Regularly evaluating your car insurance policy is essential to make sure that it still meets your requirements. Life is full of changes, and these shifts can substantially affect your insurance requirements. For example, if you've moved to a new area, your car insurance rates may vary due to different local risks. Additionally, if you have added a new driver to your policy or purchased a new vehicle, it is crucial to reassess your protection to maintain sufficient protection for all parties.

It is wise to check your policy annually or whenever you experience major life milestones, such as getting married, having children, or changing jobs. These events can require changes in your coverage levels or the kinds of insurance you carry. In addition, during these reviews, you should consider any changes in your financial situation. For example, if your income has increased, you may wish to enhance your coverage to protect your growing assets.

Lastly, staying informed about market trends can also assist you decide the best times to review your auto insurance policy. Premium rates, discounts, and offered coverage options can vary over time. By keeping an eye on these fluctuations and comparing different insurance providers, you may discover chances to save money or improve your protection. Taking the time to routinely assess your auto insurance ensures that you stay properly insured and that you are not paying too much for your policy.