Nowadays, finding ways to save money is more important than ever, especially when it comes to expenses like car insurance. Many drivers are surprised to learn that inexpensive auto insurance choices can be found that offer the coverage they need without breaking the bank. With a little research and some savvy decision-making, you can navigate the often confusing field of vehicle insurance and get a policy that matches your budget.

Understanding the basics of cheap auto insurance is the initial step towards becoming a more thrifty driver. Beginning with comparing quotes to exploring diverse coverage options, you can manage your insurance costs while guaranteeing you remain properly protected on the road. This guide aims to equip you with the necessary tips and strategies to help you find the most affordable options on car insurance, so you can drive with confidence without the money worries.

Comprehending Car Insurance Fundamentals

Car insurance is a vital aspect of responsible vehicle ownership, ensuring economic protection in the event of accidents or damaging events. It typically comprises various insurance choices aimed at safeguard both the driver and the automobile. Basic types of protection include liability, which compensates for expenses to third parties if you are the cause, and accident coverage, which pays for repairs to your own car after an incident. Grasping these types of insurance options can help motorists select the appropriate policy for their requirements and budget.

A further important component of automobile coverage is comprehensive coverage, which defends against accidents that do not involve collisions such as stealing, malicious damage, or natural calamities. A lot of motorists may question what the minimum requirements are for protection in their locale, as diverse locations have unique requirements. In general, carrying at least some form of liability insurance is obligatory, but further coverage options can offer peace of mind and potentially cut money in the long run.

When searching for inexpensive auto insurance, factors like your record, the kind of automobile you drive, and where you reside can immediately influence your insurance rates. Coverage providers determine risk variously, so analyzing quotes from various companies is a smart strategy. Furthermore, leveraging savings opportunities—such as those for safe driving records or multiple policies—can make a significant change in cost. Being knowledgeable about these fundamentals will empower motorists to make better decisions and find cheap insurance plans.

Categories of Car Insurance Policies

When considering cheap car coverage options, it's essential to understand the various types of plans available. The most common form is liability insurance, which covers losses you inflict to third parties or property in the event of an accident. This is frequently required by law and can help protect your finances if you're found at fault. Liability insurance typically consists of physical injury and property damage protection, ensuring that you are ready for litigation and medical expenses arising from an incident.

Another key type of plan is collision coverage, which pays for losses to your own vehicle after an incident, no matter who is at fault. This insurance is particularly helpful for motorists with new or more valuable cars, as it mitigates the cost of repairs. While collision insurance adds to more expensive premiums, it can be a valuable investment for those desiring security and financial security on the road.

Full coverage insurance offers a more extensive level of insurance by including a range of non-collision-related incidents, such as theft, destruction, or natural disasters. This form of insurance can help safeguard your vehicle against unexpected events that could lead to considerable costs. While comprehensive policies may be more expensive, they often prove to be beneficial for those residing in high-risk areas or possessing luxury vehicles, making it a wise option in the pursuit of cheap auto insurance choices.

Aspects Impacting Auto Insurance Premiums

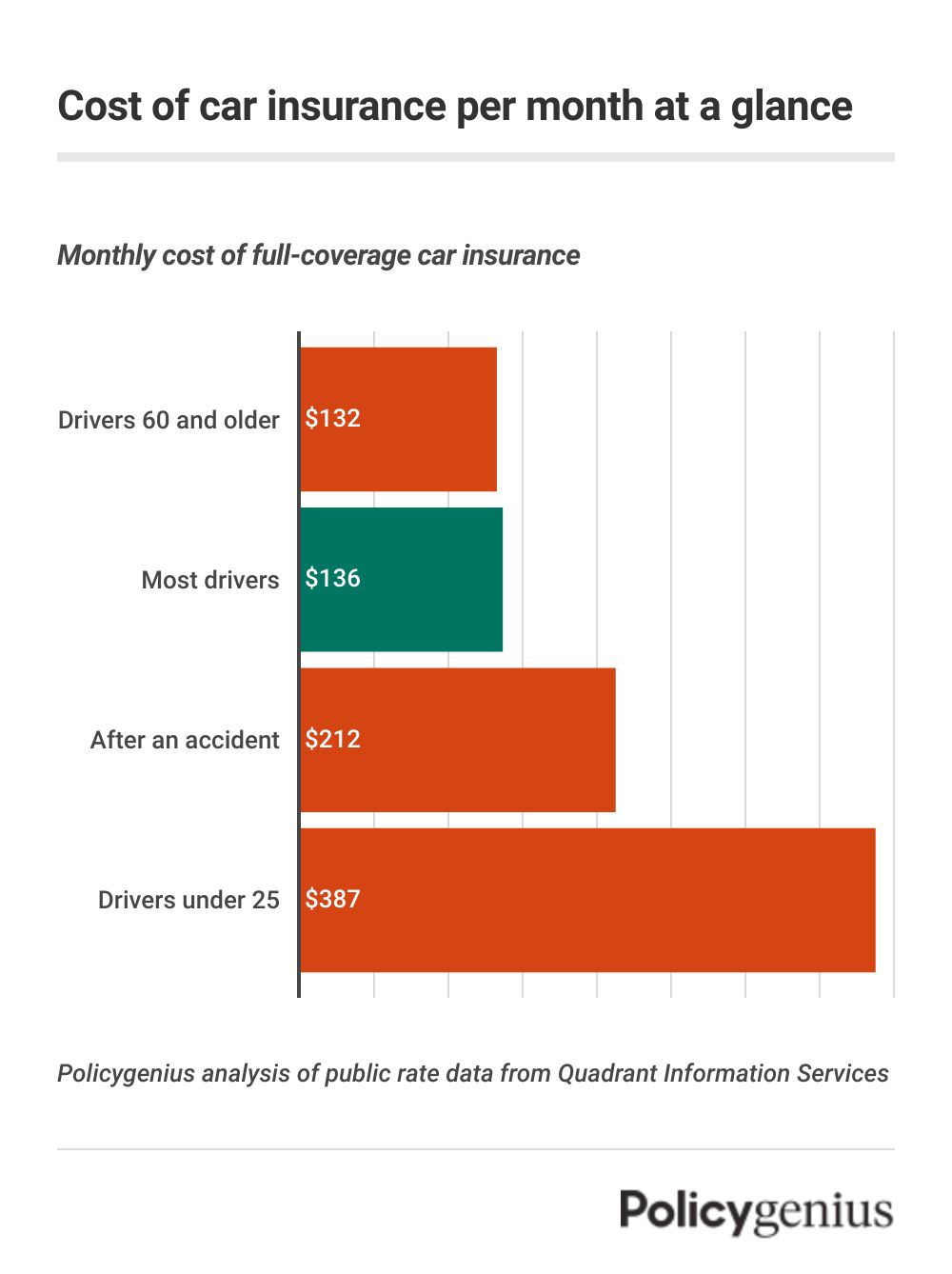

Many factors contribute to the setting of car insurance rates, making it crucial for drivers to understand which influences their costs. A main factor is the driver's age and experience. Younger drivers typically face elevated rates due to their restricted driving experience and a statistically increased risk of incidents. Conversely, more experienced drivers often benefit from reduced rates as they are seen as less likely to engage in risky driving behaviors.

Another, important factor is the kind of vehicle being insured. Vehicles with excellent safety ratings and lower theft rates usually command lower insurance costs. Conversely, luxury vehicles and sports cars tend to be more expensive to insure due to higher repair costs and an increased likelihood of theft. Additionally, the distance driven annually can impact rates; those who drive less frequently may be eligible for discounts.

Ultimately, the driver's location serves a critical role in insurance pricing. Areas with increased crime rates or more traffic congestion generally result in higher premiums. Insurance companies evaluate local factors such as accident rates and weather conditions, affecting overall insurance costs. Comprehending these factors can help consumers make informed decisions when searching for low-cost car insurance or affordable auto insurance options.

Tips for Finding Inexpensive Car Insurance

When searching for cheap car insurance, begin by comparing quotes from various insurance providers. A lot of companies present online tools that allow you input your data and receive quotes quickly. Spend the time to look past just the popular brands; lesser-known companies or community insurers might provide competitive rates. Be sure to review the coverage options included in each quote to confirm you’re getting the greatest value for your dollars.

Another effective strategy is to revisit your current coverage and make changes where needed. Consider raising your deductibles, which can decrease your premium considerably. If you have an antique vehicle, you might reduce money by eliminating comprehensive and collision coverage. Additionally, look into discounts that you may meet criteria for, such as those for safe driving, multiple policies, or good student discounts.

Ultimately, it’s crucial to reevaluate your insurance needs periodically. Life changes, such as moving, getting married, or changing jobs, can affect your insurance rates. Periodically reviewing your policy and comparing for cheaper auto insurance can lead to significant savings over time. Staying informed about alterations in the insurance market and being active in your approach will help you keep cheap coverage.

Contrasting Insurance

When it comes to finding cheap car insurance, assessing different insurance companies is crucial. Every company has its unique rating systems, coverage options, and pricing models. Begin by collecting quotes from different insurers to observe how their pricing differ for comparable coverage. Online tools can simplify this procedure easier, allowing you to input your details once and receive multiple quotes in return. This will provide you a more distinct picture of the market and aid you locate the most options.

Additionally important factor to note is the image and care of all insurance provider. While a low premium is tempting, it's crucial to confirm that the company you select is dependable when it comes to claims processing and care. Look for reviews and scores from existing or past customers to get insight into their satisfaction. A company with excellent service might be worthwhile a slightly higher premium if it leads to a more seamless claims experience in the event of an accident.

Ultimately, take note of any savings that providers may offer. Numerous insurance companies have certain discounts for safe drivers, students, and those who combine multiple policies. Soliciting about these opportunities, you can potentially lower your rates even further. Make sure to consider these savings into your comparisons to make certain that you are securing the optimal deal attainable on your inexpensive auto insurance.

Discovering Discounts and Credits

One of the best ways to secure cheap car insurance is by proactively seeking out savings and benefits offered by insurers. Many companies give various kinds of savings based on driving habits, vehicle safety features, and including personal conditions. For car insurance near me open now , good students, safe drivers, and members of certain organizations or careers may receive substantial discounts. It is important to ask your insurance provider about specific reductions that may be pertinent to you, as well as to contrast offers from multiple companies.

Another way to lower your policy cost is by taking advantage of benefits that companies commonly give. These can include savings for merging several policies, such as homeowners and auto insurance, or for maintaining a clean driving track record over numerous years. Additionally, some insurers may offer rewards for opting for digital billing or for paying your payment in complete upfront. Each company has its own guidelines, so it's beneficial to explore and confirm you are receiving all applicable benefits.

Lastly, consider reviewing your insurance needs periodically. Life changes such as relocating, transitioning to a new job, or acquiring a newer vehicle can change your policy premiums. Regularly reviewing your policy can help you find ways for extra savings or credits based on your current situation. Being informed and proactive will enable you to make smarter decisions, leading to less expensive car insurance options.

Common Misconceptions Concerning Automobile Coverage

A lot of drivers believe that the most affordable car insurance policy is invariably the optimal option. While affordability is important, it is important to factor in the protection provided. Some budget policies might lack necessary coverage, such as liability or extensive protection. This can cause substantial out-of-pocket expenses in the event of an event or deterioration to the vehicle. Therefore, it is essential to contrast the details of various policies rather to focusing only on the cost.

One more common misconception is that maintaining a strong credit score does not influence car insurance rates. In fact, many insurers use credit scores as a criterion when calculating premiums. A low credit score can result in elevated rates, while a good score can facilitate obtain diminished premiums. Drivers should be mindful of how their credit history can influence their insurance costs and take measures to enhance their credit if needed.

Lastly, some drivers assume that their insurance rate will remain the same amount each year. In reality, car insurance rates can vary based on different factors, including changes in individual circumstances, new legislation, or alterations in the insurance market. Regularly examining your insurance policy and seeking out better deals can help confirm that you are constantly getting a fair price for your coverage. Keeping updated about your options can result in significant savings over time.

Checking Your Insurance Policy Consistently

Consistently assessing your vehicle insurance coverage is important for ensuring you are getting the most suitable coverage at the lowest price. Situations often shift, such as moving to a new location, acquiring a new vehicle, or modifications in your driving behavior. All of these factors can significantly impact your insurance requirements and pricing. By checking your policy annually or whenever significant major changes take place, you can identify prospective discounts and ensure your coverage continues to be relevant for your situation.

When reviewing your policy, focus on the coverage limits, deductible amounts, and the types of insurance you carry. You may find that you are spending for protection you are no longer required, or on the other hand, that you require additional insurance that could offer you reassurance. Furthermore, it's crucial to compare prices and compare quotes from various insurers during your assessment. Insurance companies often update their rates, and by looking at different choices, you may discover cheaper auto insurance that offers comparable or better coverage.

Moreover, think about leveraging any offers that may be available. Several insurance providers offer reductions for safe driving records, combining policies, or even for membership in certain organizations. Communicate with your insurer and find out about available savings that you may overlook. Regular insurance reviews can both help you save but also make sure that you are sufficiently covered on the highway.